Building a resilient investment portfolio requires an intentional focus on diversification to mitigate systemic risks while positioning for emerging opportunities. Large-scale health disruptions often catalyze rapid shifts in consumer behavior and institutional priorities, making a balanced approach across sectors and asset classes essential for long-term stability. A comprehensive allocation model incorporates defensive positioning with growth-oriented exposure to ensure the preservation of capital during periods of heightened volatility.

Healthcare stocks represent a foundational component of any portfolio designed to withstand institutional challenges. The demand for pharmaceuticals, biotechnology, and medical supplies tends to intensify during periods of collective health concern, benefiting companies that produce vaccines and essential treatments. Telemedicine platforms and medical logistics providers also experience increased adoption as traditional systems adapt to new constraints. Prudent investors focus on firms with robust research pipelines and established manufacturing capabilities to capture this defensive growth.

Consumer staples provide a critical layer of stability because they represent essential goods that maintain demand regardless of broader economic conditions. Large-scale producers of food, beverages, and household products typically offer consistent returns and lower volatility than cyclical sectors. These assets function as a stabilizer within a broader portfolio, providing reliable cash flow when more speculative areas face downward pressure. Maintaining exposure to these high-quality staples ensures that the portfolio has a solid floor during downturns.

Technology infrastructure remains a significant driver of growth as organizations and individuals shift toward digital communication and remote work. Companies providing e-commerce solutions, cloud computing services, and cybersecurity become indispensable during periods of social distance. Investing in the underlying digital infrastructure that supports remote collaboration and commerce provides exposure to long-term structural changes in the global economy. This sector often leads the recovery phase as new technological habits become permanent features of daily life.

Utilities and essential infrastructure offer predictable income and low sensitivity to market fluctuations. Water, electricity, and natural gas services are necessary for the functioning of society, ensuring stable demand even during significant disruptions. These assets often distribute regular dividends, making them attractive for capital preservation and income generation. Including utilities in a portfolio provides a buffer against the more volatile swings seen in manufacturing and luxury sectors.

Fixed-income assets like government bonds and high-quality corporate debt provide a necessary safety net. Debt instruments from stable economies are historically viewed as low-risk havens that protect capital when equities face significant selling pressure. High-quality corporate bonds offer slightly higher yields while maintaining a conservative risk profile, allowing for modest income without excessive exposure to default risk. A strategic allocation to these instruments balances the higher growth potential of the equity portion.

Real estate investment trusts focused on data centers and logistics facilities benefit from the expansion of the digital economy. The increasing reliance on online services requires physical infrastructure to house servers and facilitate the distribution of physical goods. These specialized properties offer regular rental income and potential appreciation as the demand for digital space and efficient delivery networks grows. This approach allows for real estate exposure that is aligned with technological progress rather than traditional office or retail sectors.

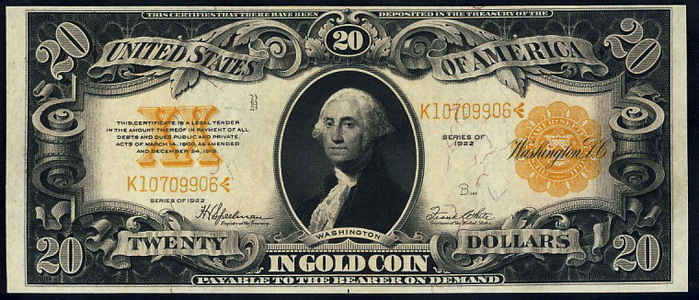

Gold and precious metals serve as a historical hedge against economic uncertainty and currency debasement. These assets often move independently of broader markets, providing a diversification benefit during periods of extreme volatility. Investors use gold to maintain purchasing power and reduce the overall risk profile of the portfolio when institutional frameworks face trust issues or inflationary pressures. A modest allocation to hard assets provides an essential insurance policy for long-term holders.

Liquidity remains a vital tool for navigating uncertain environments and capitalizing on sudden market changes. Maintaining a portion of the portfolio in cash or equivalents allows for rapid reallocation when new opportunities arise or when specific assets reach attractive valuation levels. This dry powder ensures that the investor can act decisively rather than being forced to sell depressed assets to meet financial obligations. A well-constructed portfolio balances fixed allocations with the flexibility provided by immediate liquidity.